A personal budget plan is a financial plan where you are keeping track of all our expenses as well as logging all your income to get an overall balance at the end of each month. Personal budget is necessary to effectively and efficiently make an inquiry into your expenses and to balance out all your expenses so they are lower or at least equal your income. Without a budget plan it is very easy to create a personal deficit where you are spending more than you earn and then you will need to borrow money by taking out a loan or cut your spending drastically in the next month. Because salaries are usually pretty stable and have only slight increases or decreases we can plan ahead and think of ways how to improve out spending to decrease it in those areas that eat up our budget the most.

When you are creating a budget plan then you need to keep track of all your income that includes your salary, passive income, pension, social security and any additional money that you get into your bank account or in cash. But most often income is the easiest part and keeping track of expenses is a bit more tricky. Usually we are shopping in many different locations with cash, credit card, debit cards, online payments as well as with payday loans. And that poses a big challenge to overcome. In ideal world you should need to register all your payments and expenses down to each cent but in real world that often is not practical so you need to devise a solution that does not take that much of your time. I usually create a list with all the payments that are bigger than 10 or even 20 lari and that immediately gets rid of about half of those smaller things. But the rest of those expenses I try to group into categories like:

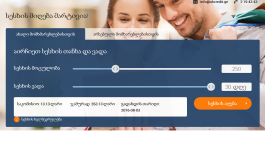

*რეკლამა- Essential payments(rent, debt, cable, internet);

- Food;

- Car expenses(petrol, repairs);

- Fun (entertainment, parties);

- Miscellaneous (all the other things);

- Savings.

If you are using only your credit or debit card then keeping track of your payments gets a bit easier but you should still set aside an hour or more each week where you go over your bank statements and group them together in all those various categories.

When you have done your budget properly for a couple of months you will start to see some patterns where your money is going and you now can start improving and trying to cut spending by substituting or by eliminating some expenses. For example if you are drinking a Late coffee each morning you can switch it to an instant coffee and save a lot of money. Of if you are using cable television you can cut that off and use only your computer and internet where you can watch most of your favorite movies and tv series. The possibilities are endless but first you need to take a good look at your income and expenses and only then you will have the data to use and to improve your budget.

The most important thing is to not overspend and also try to save money for some larger expenses and some unexpected expenses because they tend to come from nowhere and can take you by surprise. But if you have an emergency money stashed away then you can use that to pay those unexpected expenditures and you will not need to take out those fast loans.